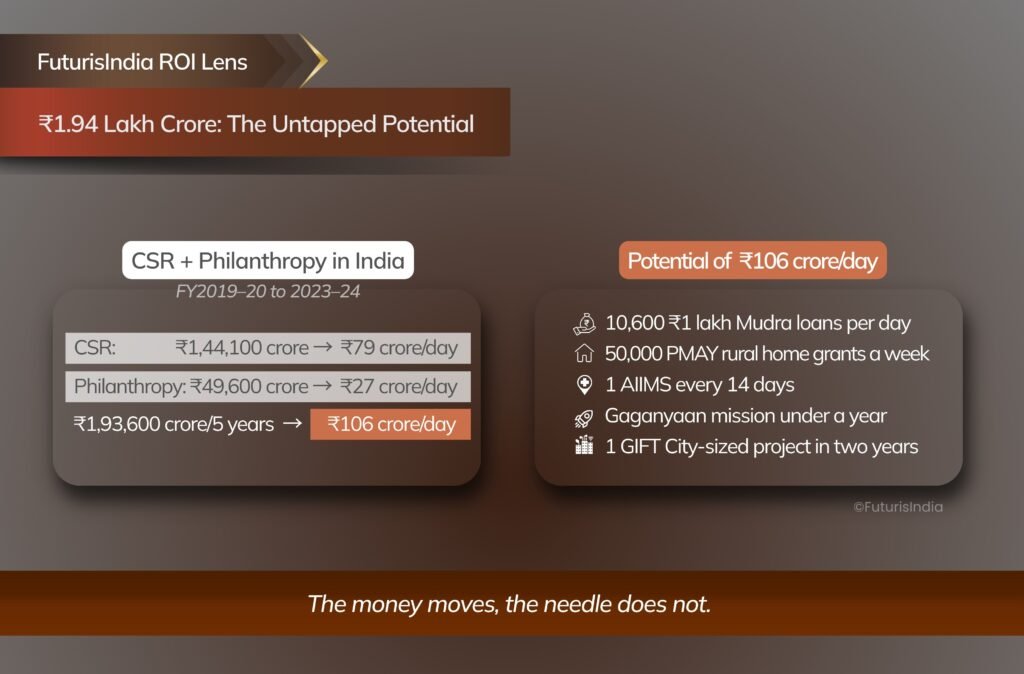

India is sitting on a powerful opportunity, and unmindfully dispersing it. Between 2019–20 and 2023–24, nearly ₹1.94 lakh crore was deployed through Corporate Social Responsibility and private philanthropy – an average of about ₹106 crore a day. CSR totalled ₹1,44,000 crore, an 89% surge, while private philanthropy added another ₹49,600 crore. After five years of this flow, the outcomes remain fragmented and modest, raising both developmental and generational concerns.

This is not a crisis of generosity or intent. Over 55% of companies exceed the statutory minimum for CSR. Private philanthropy has grown in both scale and participation. Compliance is not the primary issue either – both mandatory CSR and voluntary philanthropy largely follow the same playbook, concentrating on the same favoured sectors. A lack of strategic imagination has reduced this substantial capital to fragmented incrementalism. The Republic receives, but does not transform.

At present, CSR and philanthropic investments deliver suboptimal returns and have not produced any fundamental shift in the nation’s trajectory. Though this money is just a small percentage of India’s total social sector funding, it is unbound by electoral cycles or populism. It has the potential to seed breakthroughs and fast-track India’s Mission 2047.

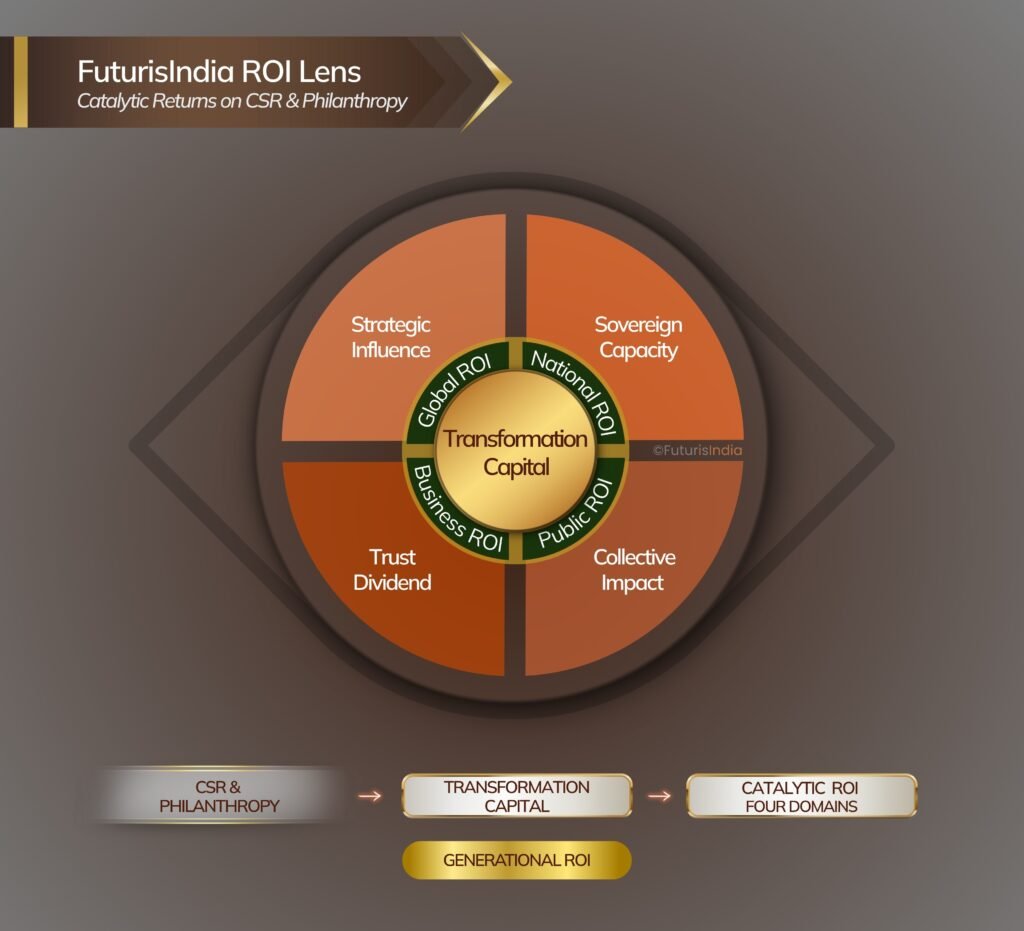

FuturisIndia ROI Lens

FuturisIndia reframes CSR and Philanthropy as Transformation Capital, a catalyst for nation-building. It gives a strategic identity to what is otherwise seen as compliance or charity, and calls for catalytic returns for all stakeholders – nation, public, and contributors.

The FuturisIndia ROI Lens evaluates returns on social investment across four reinforcing domains: National, Public, Business, and Global. These are anchored in a unifying goal – Generational ROI, compounding benefits that will shape India’s future through 2047 and beyond.

The ROI Lens, set in the Indian context, offers universality to leverage an often-unstructured asset class – any nation can use it to evaluate their own social spending.

National ROI

This capital could forge generational sovereign capacity – building world-class institutions of learning, funding ambitious moonshot research, and creating the industries of India’s future. Instead, over half a decade, it was atomised across 35,000 to 60,000 projects annually, blunting its potential. This dispersed use of capital to fill basic development gaps risks enabling state complacency, inadvertently displacing government responsibility, and reinforcing the very deficiencies it aims to fix.

Over half of all CSR funds went to education and healthcare, but even there, sectoral transformation has been limited. Innovation, the engine of national growth, remained ignored; a paltry ₹128 crore went to technology incubators, a sum less than a big-star Bollywood film’s budget.

Potential: Kaveri engine; a homegrown GPT-like AI ecosystem.

Reality: No breakthrough that altered India’s trajectory.

Public ROI

CSR and philanthropy have built schools, funded clinics, launched training centres, and supported livelihoods. Change is evident in localised pockets, but public value has not expanded enough to become embedded in collective awareness. If the average citizen knew how much CSR and charity money was spent on their welfare, the likely reaction would be: ‘Then why don’t we see a drastic change?’

Spending is unevenly distributed across sectors and regions, and fails to make notable advancements in either dimension. Most funds cluster in a handful of economically advanced states such as Maharashtra, Gujarat, Karnataka, Tamil Nadu, and Delhi, leaving vast regions underserved. Even within high-recipient states, critical gaps remain, as illustrated in the education infographic later in this report.

Potential: AI for All schools; Rejuvenation of Metropolitan areas with circular economy principles, zero homelessness, and clean public spaces.

Reality: Visible shift is missing; neither collective welfare nor public trust in contributors has compounded.

Business ROI

Despite sizable social spending, corporate India earns little reputational benefit, crisis support, or respect as nation builder. Project-level or PR gains are temporary, not accumulating into long-lasting credibility. Several top philanthropists remain unrecognised by the general public. In a civilisation that worships Laxmi and Laxminarayan, wealth creators are mistrusted – a sentiment readily exploited by politicians. With significant private philanthropy and 86% of total CSR funding, bridging this divide is possible. Yet, boardrooms that pursue financial returns with rigour rarely apply the same discipline to social investment, leaving a persistent deficit in real value captured.

This failure was starkly exposed in early 2023 when a major corporate group, just after making one of Asia’s largest philanthropic pledges, faced allegations from a foreign research firm. There was no organic popular defence. Instead, segments of the population unquestioningly accepted the critique, demanding punitive action. This was a warning signal: substantial, long-term giving is failing to provide a protective moat in crisis.

Potential: A new positive compact between corporate India and the citizens.

Reality: No trust dividend; the society-wealth creators relationship remains fragile, with costs to the nation.

Global ROI

India Inc has a worldwide presence and ambitious growth plans but lacks a meaningful philanthropic footprint abroad. Overseas contributions are limited, and when they happen, they seldom alter global perceptions or bring strategic value for the country or the business community.

The Indian government’s Vaccine Maitri initiative, at a procurement cost of ₹313 crore, showed how targeted action can build goodwill – for a sum less than 12 days of India’s private philanthropic giving. Similarly, Jaipur Foot highlights what is possible. However, there is a broader negligence to harness philanthropy for building credibility in key markets. India Inc rarely undertakes even low-cost initiatives such as showcasing their successful social programmes for trust-building.

Potential: A Gates Foundation–style health initiative or Jan Aushadhi–like network in strategically important low-income countries.

Reality: A failure to proactively shape perceptions and strengthen India’s brand on the world stage.

The Opportunity Cost of Fragmentation

Looking back over the past five years of CSR and philanthropy, the opportunity cost is stark. A substantial amount of money was spent, yet no transformative legacies exist.

Education is the most favoured sector of corporate India. Despite substantial allocation, in addition to the centre and state government budgets, sectoral progress has been limited. No Indian university ranks among the global top 100. School dropout rates and quality remain persistent concerns. Physical and digital infrastructure fall short of what is necessary to adequately prepare future generations. Maharashtra, the richest state and largest CSR recipient, still lacks primary schools in 1,650 villages, upper primary schools in 6,563, electricity in 5,373 schools, and separate toilets for girls in 3,335 schools.

The sector that gets the most funds and priority proves that the quantum of spend does not guarantee catalytic return.

What could have been a powerful lever for nation-building remains a record of thousands of scattered projects. Although funds are increasing each year, outcomes will remain disappointing unless the approach changes. Yet this opportunity cost continues to slip under the radar.

Transformation Capital

CSR and philanthropy must be recognised as funds of national consequence. The conversation cannot remain about inputs (how much was given) and outputs (what was done); it must be about the futures created.

Not spend volume, but strategic yield. Not grant cycles, but generational impact. Not giving back, but investing forward.

The central question is this:

What did nearly ₹1.94 lakh crore build in five years that India will remember in 2047?

The answer is sobering.

Currently, all stakeholders – the nation, its citizens, and its CSR and philanthropic contributors alike – receive minimal returns. That gives a compelling reason for a reset, which requires a mindset shift, a departure from past approaches, and a decisive move towards future-building. Every day of the status quo underutilises a powerful asset.

The fundamental requirement for meaningful change is that all stakeholders first own the problem. Until they do, providing detailed solutions is not just premature, it is counterproductive. The potentials in this report signal the futures India could have already built if capital was allowed to be strategically deployed. Beyond that, this report intentionally avoids prescriptive answers and instead offers a new lens to catalyse a long-horizon mindset shift. If the lens changes, effective roadmaps will naturally emerge from the stakeholders collective.

India is not underfunded; it is under-imagined. The money moves. Now, the needle must too.

Data Sources

Ministry of Corporate Affairs, CSR Portal

EdelGive Hurun India Philanthropy List

All figures rounded.

As per our Terms of Use, limited content (text and audio-visual) may be shared with proper credit. Full reproduction in any format is strictly prohibited. See Clause 5 for detailed usage and attribution guidelines.